Industry compliant, end-to-end lending management

Consumer Lending

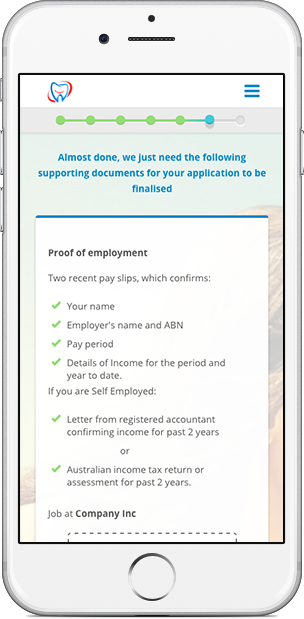

Many finance applications typically require a lengthy manual process, which is not only time consuming but can also be daunting for a consumer that’s already under personal pressures. Recognising this, we've developed a sleek application process that’s entirely digital and accessible by consumers on both mobiles and desktops, while giving your business complete control over your lending criteria.

Customisable, multilingual, and extremely user friendly... We can provide an integrated end-to-end consumer lending solutiuon for any size business, anywhere in the world.

Disrupting the lending industry

Our consumer lending platform includes all the tools to integrate a complete lending and financing system into your business operations in a way not seen before.

With our apps, your customers can make their request for finance quickly and easily, and our technology provides them with a real-time response to their application. There's no waiting for approval, manual credit decisioning or tedious paperwork as the platform automates these processes... That's practically unheard of up until now.

Users are prompted to simply follow the steps as the app guides them through the process. Once approved, the platform will handle all aspects of settlement, collections and recovery giving you the peace of mind that the finance side of the process has been handled automatically and securely.

Solve complexity with automation

IP Ventures delivers a unified solution for automating origination, credit decisioning, portfolio management and collections. From simple credit requests to complex loans requiring extensive due diligence, we orchestrate the origination lifecycle from end to end so you can make the right decisions and make them faster to deliver outstanding customer experiences, shorten time to revenue and minimize risk.

We offer highly responsive service to your customers with multi-channel applications, instant decisioning and straight-through processing for all types of credit and lending requests. You will cut processing time and costs with automated workflows that guide every step in the origination process.

We streamline data gathering and enrichment with pre-built adaptors that consolidate information from virtually any data source. Our platform increases compliance and reduces risk with industry-standard analytic models operationalized in your risk decisioning processes.

The platform can enhance business agility with user-friendly configuration tools to create and change user interfaces, rules and processes, enabling immediate response to new opportunities, competitive challenges and regulatory changes.

Features that accelerate your workflow

CONVENIENT DOCUMENTS

Obtaining all required information is easy, as customers can submit documentation directly to your business via the App. Compliance is made simple with workflow and document management capabilities as standard.

ALWAYS OPEN

24/7 availability allows users with an Internet connected device to access the system at any time, vastly expanding your business coverage and customer service.

DETAILED AUDITING

Tracking and audit trails make it easy to prove compliance with current industry regulations, and flexible workflow features allow you to make adjustments quickly as regulations change.

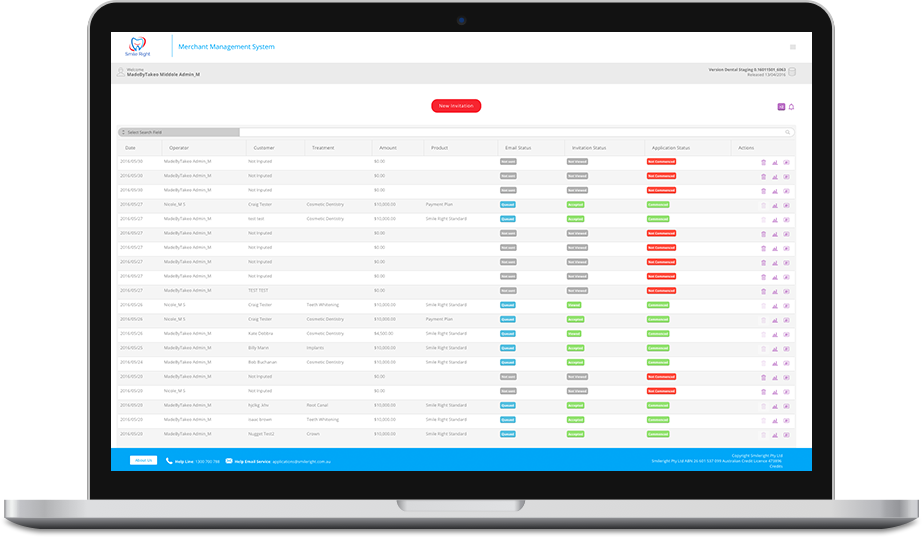

CLIENT MANAGEMENT

Every step of the client experience is managed and reported on through the complete "life cycle" of the lending process. You know at all times the position and profitability of each customer.

Powered by ePremium

e-Premium is our state of the art lending solution - Powerful, automated, compliant.

Used by financiers, lenders, and financial institutions (funders) to acquire and manage both commercial and consumer loans across a diverse range of asset classes and portfolios, ePremium handles the entire process - origination, assessment, aquisition and compliance.

Specifically, e-Premium provides low-cost end-to-end fintech payment processing facility which disrupts the complexity of financial management by automating end-to-end loan acquisition, processing, and document management, while strictly complying with the required legislation for the industry.

Unique solutions for your organisation

Need a Developer?

IP Ventures provides you your own technology partner, giving you access to the latest in coding, designers, system architects and programmers with extensive industry experience.

Also the Company provides you the resources to fund your project fast making your business real in a snap.